8 Household cost burden

This section provides an analysis of cost burden within Chesterfield County disaggregated by tenure, income, household type, and race/ethnicity.

8.1 Background

Cost burden is the standard by which most academics and practitioners measure housing affordability and is the result of the 30 percent standard. Households spending more than 30 percent of their income on housing costs are housing cost-burdened, while households spending more than 50 percent are severely housing cost-burdened. Although cost burden can be a reflection of insufficient wages to afford housing, it can also point to a growing need for more diverse housing options.

While other measures have their benefits in communicating the need to address housing affordability (Chapter 2), the 30 percent standard has not only been shown to be accurate in representing the overall community, but it can be easily understood and applied at different scales. For these reasons, and for the range of demographic and socioeconomic crosstabs available for cost burden in CHAS data, we use this standard.

8.2 Tenure and income

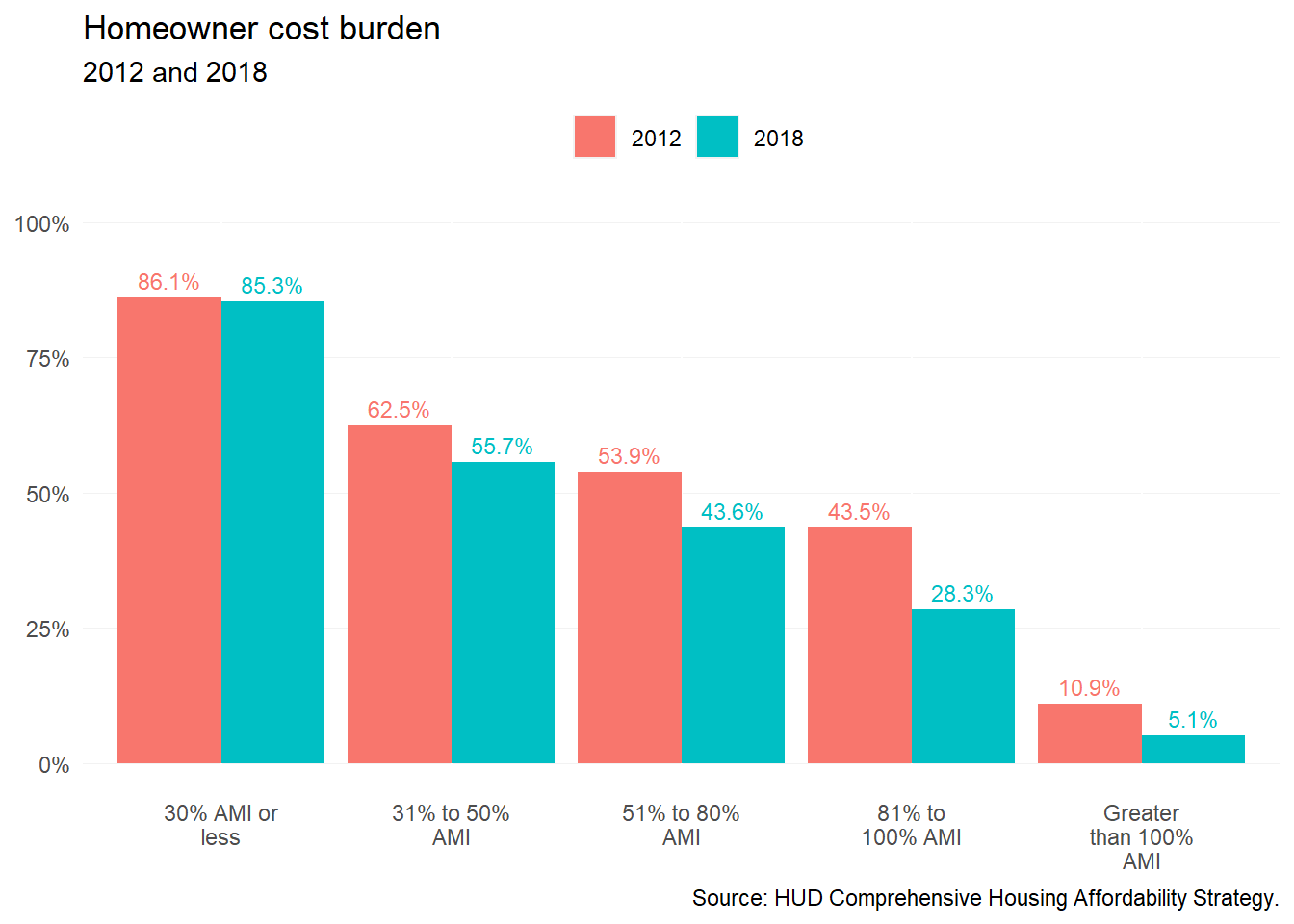

For homeowners, cost burden has decreased across the board. There were 21,305 cost-burdened homeowners in 2010, but that number decreased significantly to 16,945 in 2018—a 20 percent decrease. The total share of cost-burdened homeowners has shrunk, from nearly one in four (24 percent) in 2010 to 18 percent in 2018.

But cost burden is still substantial among households with lower incomes, especially extremely low- (30 percent AMI or less) and very low-income (31 to 50 percent AMI) homeowners, where over half of homeowners at these incomes are cost-burdened, 85 percent and 56 percent, respectively. Worse yet, the majority of cost burdened homeowners at these incomes are spending more than 50 percent of their income on housing costs.

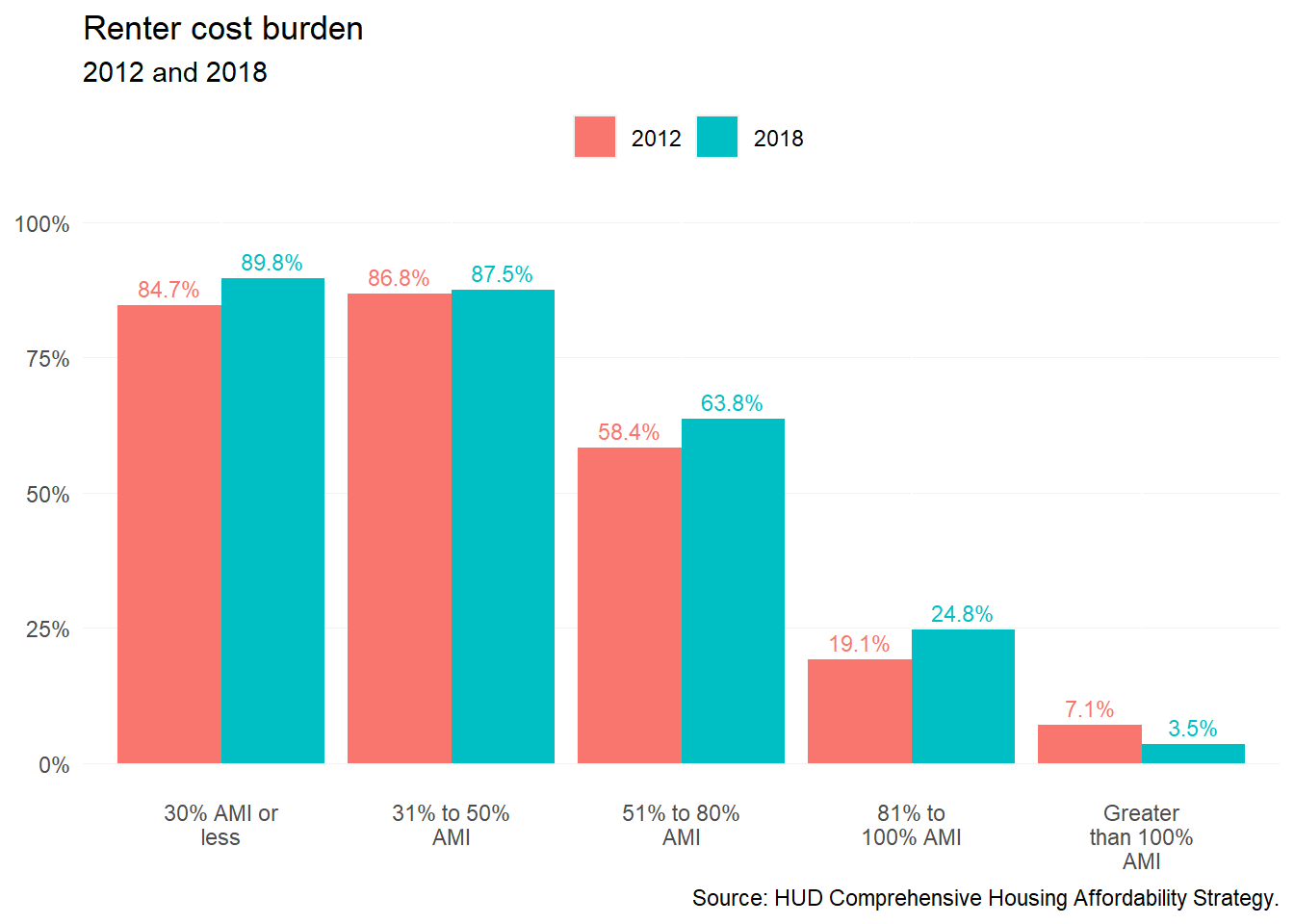

With the share of renters increasing in Chesterfield County, the share of renter households experiencing cost burden has been in decline in recent years—dropping from 45 percent in 2013 to 42 percent in 2018. But the actual number of cost-burdened renters has been on the rise—from 10,495 at the start of the decade to 12,795 cost-burdened renters in 2018.

Separating out by income group shows that declining cost burden is not a shared experience. Income groups making less than 80 percent AMI have seen an increasing share of cost-burdened renters. Those increases have been greatest among extremely low-income renters (85 percent to 90 percent) and low-income renters (58 percent to 64 percent) between 2012 and 2018. The decrease in higher income renters (80 percent AMI or more) experiencing cost burden shows an increasing number of higher earning renters entering the county rental market, nearly 4,000 higher earning renters without cost burden by 2018.

8.3 Household type

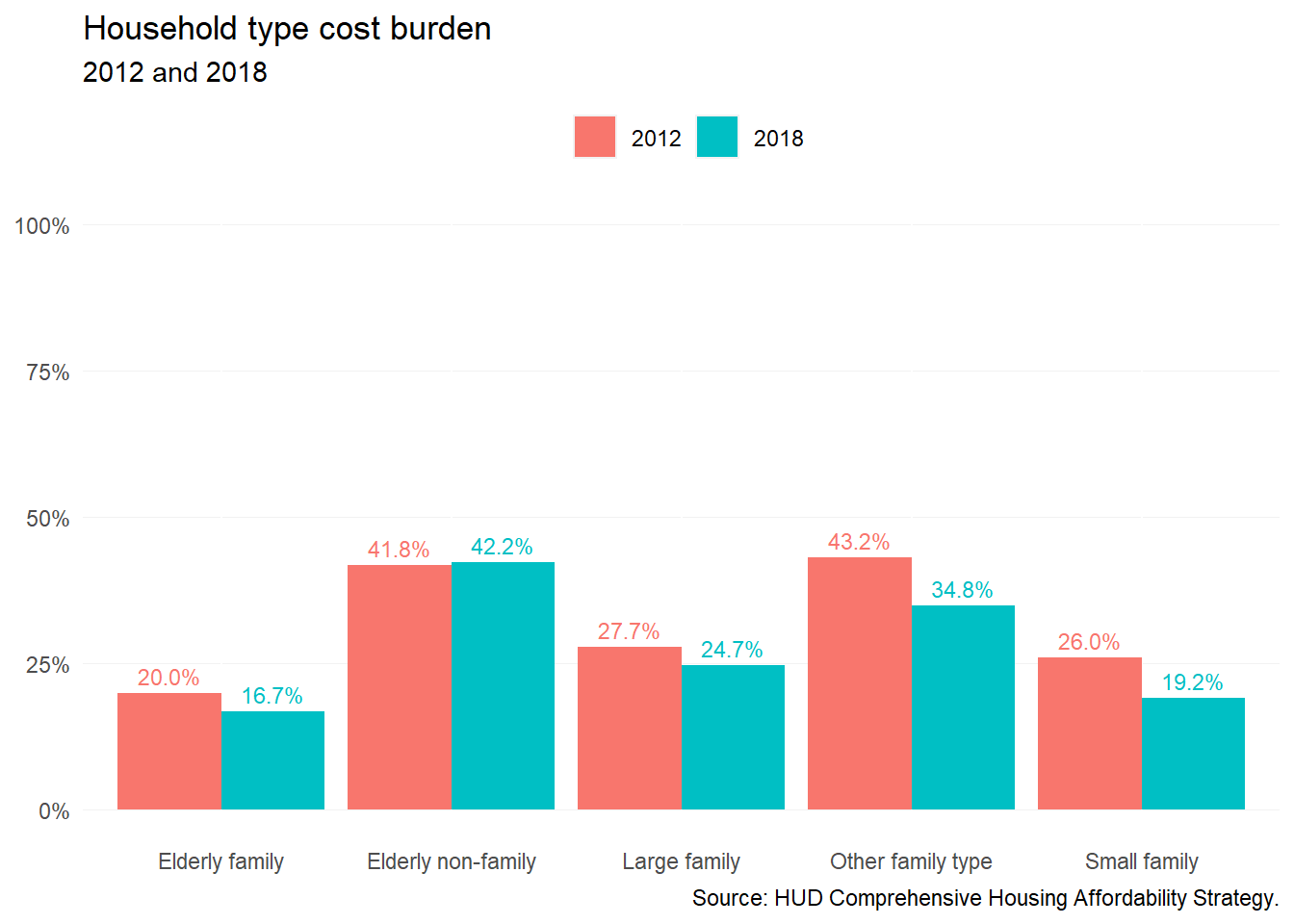

As families grow and seniors age, expenses tend to increase as well. More mouths to feed can often mean less flexibility in spending towards essential needs like housing. For aging households on fixed incomes, increasing healthcare costs can not only lower a housing budget, but can imply a growing need to support aging-in-place.

In the county, elderly non-family households (i.e., single seniors living alone) experience cost burden at a disproportionate rate. In 2018, 5,885 elderly non-family households (42 percent) were cost-burdened—higher than any other household type. The brunt of this cost burden was shouldered by homeowners (3,730), but 69 percent of seniors living alone (2,155) who rent were cost-burdened, indicating a clear need to address senior affordable rental housing in the county.

The second household type experiencing a significant amount of cost burden (35 percent) was non-elderly non-family households (i.e., single adults living alone, or with a roommate). Although decreasing eight percentage points since 2012, a large share of single adults were still cost-burdened—from 8,455 to 6,595 households. Over half (56 percent) of those 6,595 households are renters.

Cost burden among these two household types exhibits a growing affordability challenge for single adults regardless of age. Without additional income that comes from other family members in a household, affording a home in the county can be financially difficult.

8.4 Race and ethnicity

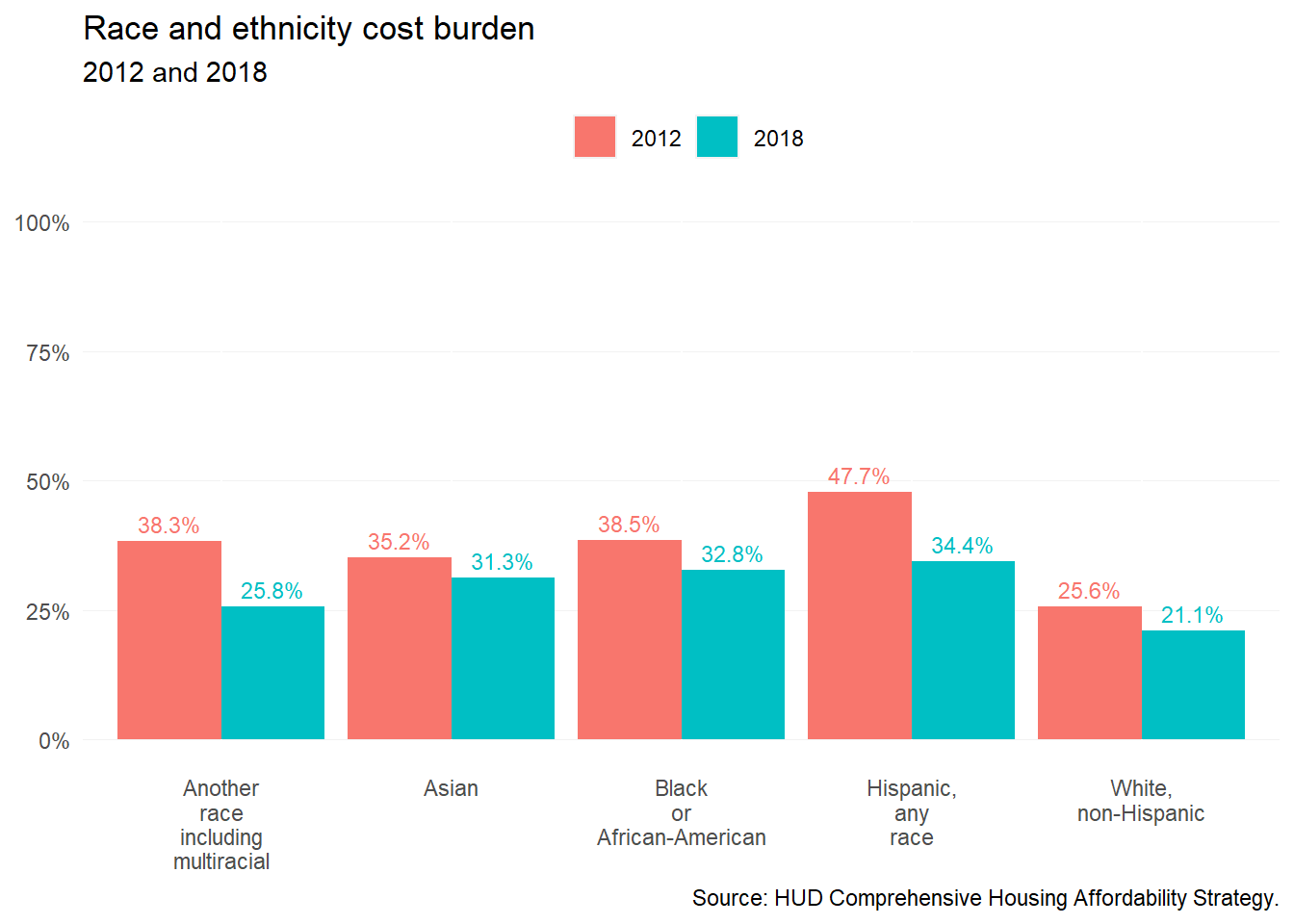

In the county, there are major disparities in cost burden between racial and ethnic groups. In 2018, the share of cost-burdened white households was ten percentage points lower than the share of Black, Asian, and Hispanic households.

In spite of these disparities, the share of cost burdened households of color has been in a steady decline. Most significantly, Hispanic households have experienced the greatest decrease in cost burden—from nearly half of all Hispanic households in 2010 to only one in three (34 percent) in 2018.

These decreases in cost burden among households of color may be in large part to the relative affordability and attractiveness of Chesterfield County to growing families.

8.5 Structure type

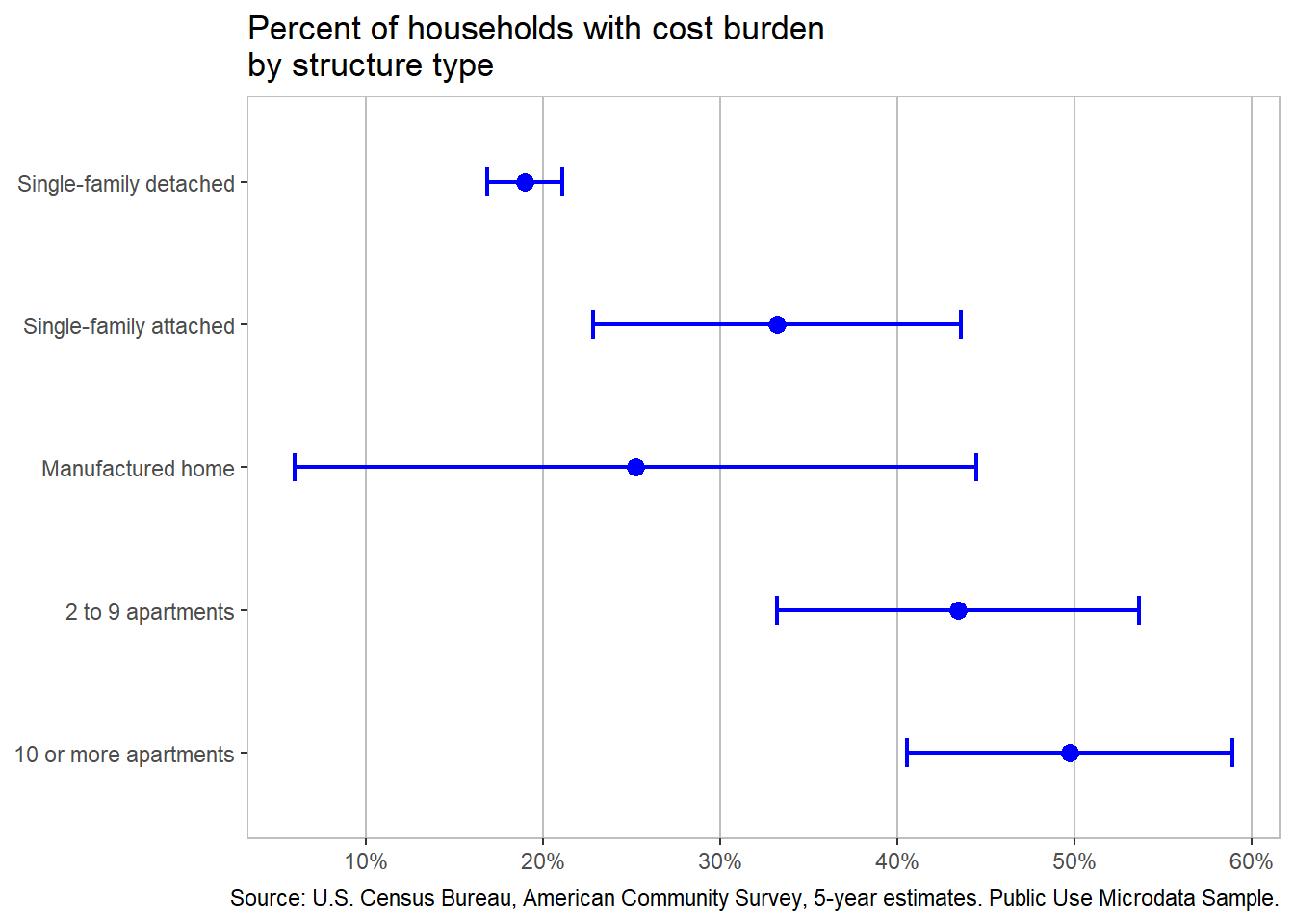

Cost burden also varies across the types of buildings Chesterfield residents call home. The highest levels of cost burden (above 40 percent) are found in the county’s multifamily stock, which are occupied almost exclusively by renters. Manufactured homes and single-family attached homes have cost burden rates closer to the countywide average of 25 percent.

Caution should be exercised when interpreting these results. The horizontal lines in the figure below represent 90 percent confidence intervals for each estimated percent. Building types that make up a smaller share of the county’s housing stock have fewer samples, resulting in lower data reliability. For example, the actual percent of cost-burdened households in manufactured homes may fall between 6 and 44 percent—a very wide range.

Single-family detached homes, while the most expensive housing type, have the lowest rate of cost burden for a number of related factors. These include homeowners having relatively high incomes, and (for long-term homeowners) relatively low mortgage payments.

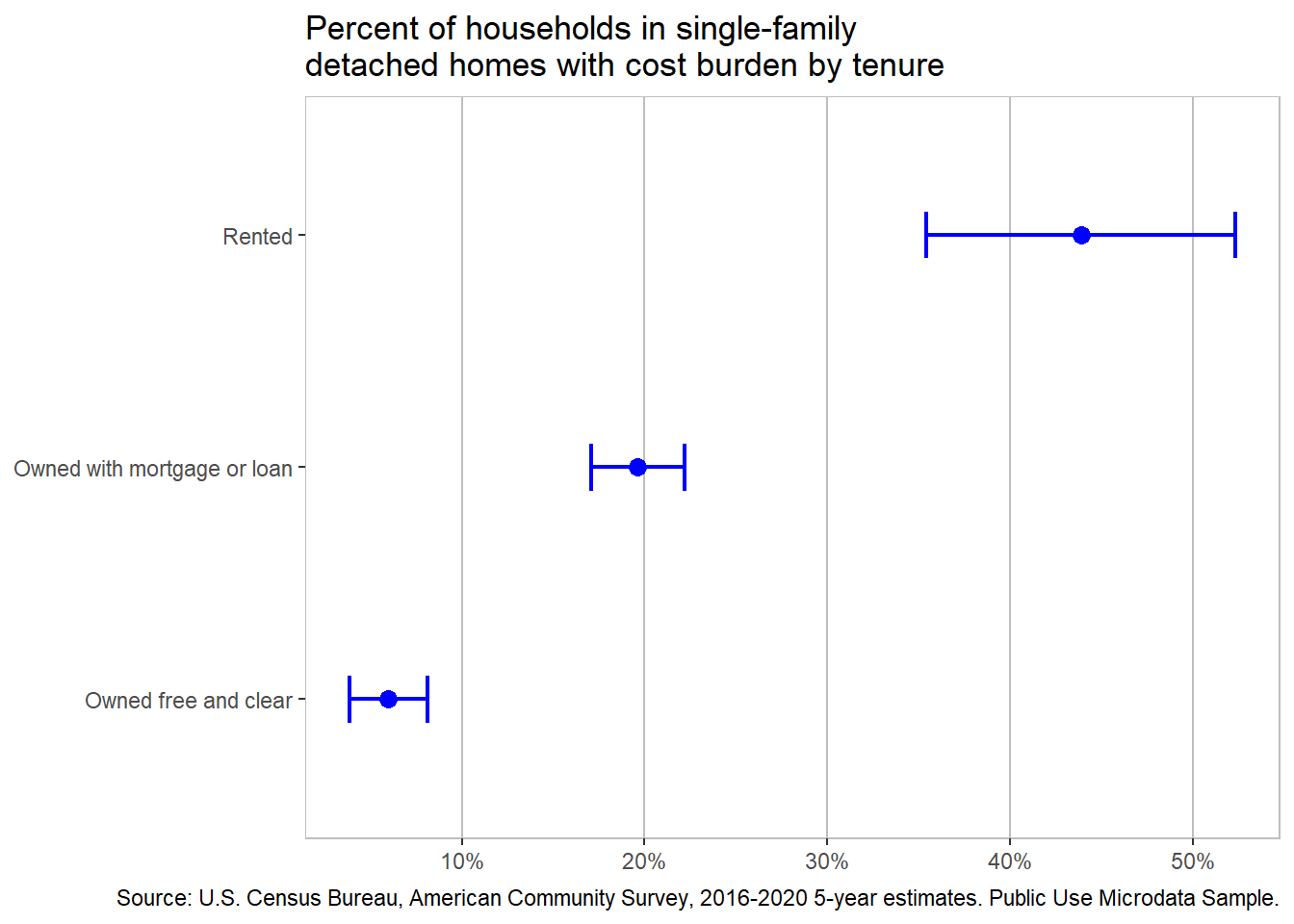

However, roughly 10 percent of single-family homes in the county are renter-occupied. These households have cost burden rates much higher then their homeowner counterparts

8.6 Spatial distribution

Levels of cost burden also vary across different areas of the county, generally following existing socioeconomic patterns. While the share of homeowners experiencing cost burden is distributed relatively evenly among Chesterfield’s census tracts, there is greater spatial contrast among renters. The highest levels of rent burden are found in neighborhoods along the Route 1 and eastern Hull Street Road corridors.

8.6.1 Homeowners

8.6.2 Renters

8.7 Takeaways

- Cost burden is not felt equally among Chesterfield County residents. Lower income households, especially renters, adults living alone, seniors and non-seniors, and households of color experience cost burden at disproportionate rates in the county.

- While the share of households of color experiencing cost burden has been in decline, more and more lower income households are becoming cost-burdened.